ATTENTION Directors, CEO's and Executive Teams

Forget Temporary Government Stimulus Packages - This Endures!

Forget Temporary Government Stimulus Packages - This Endures!

—Frank Genovesi, Creator of Deduct Your Home TEAMS

- Dr. Brett Davies, National Firm - Tax Lawyer

BJuris, LLB, LLM, Dip.Ed. B.Arts (Hons)

CTA, AIAMA, MBA (Murdoch), SJD (UWA)

Dear Directors, CEO's and Executive Teams,

Right now, there is a very clear path to navigating OURSELVES out of the UNCERTAINTY we are experiencing.

The opportunity is great - though the consequences for failing to act are greater.

Not all organisations will be able to take advantage of it, but for those who are action takers, and believe job losses and 'square-peg-round-hole' redeployment are NOT a plan, let me show you one of the most distinctive and powerful fiduciary strategies of our time.

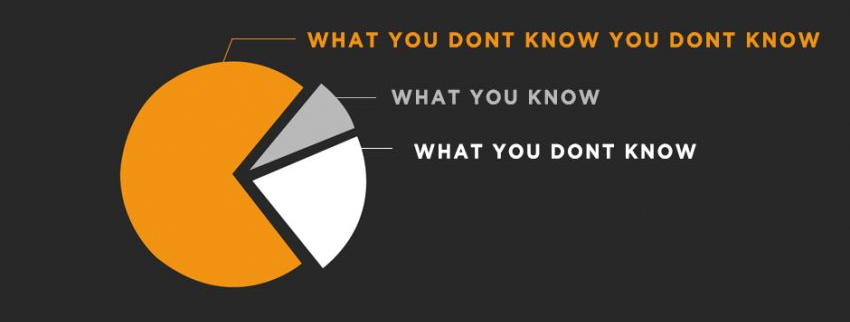

Unfortunately, everybody - Directors, CEO's, Executive Teams, Business Owners, Managers and even the BEST Thought-Leaders alike - 'don't know what they don't know'.

Yet they forge ahead making all manner of decisions, telling themselves they've 'done their due diligence' and 'covered their bases' - only to get up in the morning and do it all over again, day-after-day, month-after-month, year-after-year.

Astonishing isn't it?

When it comes to decision making and risk management, we ALL start in the same challenging situation:

Even if you are at the top of your game, top of the leader board, the best in the world; it's vital to remind yourself of this and to remain eager to improve.

We've all made decisions we believed were needed to be made, even in the absence of many unknowns.

However, through the power of repetition, this acceptance of being 'OK' with what we don't know, quickly became an ingrained habit that many of us have and continue to find extremely difficult to break.

Henry Ford understood quite clearly the power of 'knowledge delegation' when he famously said ...

Once you accept that 'you don't know what you don't know' and decide to address your 'Untapped Knowledge Gap', it's only THEN we help you determine your most effective and straight forward path ahead.

|

Deduct Your Home TEAMS for Employers |

|

|

|

Deduct Your Home TEAMS for Employees |

Great ideas don’t stand alone. We provide all you'll need to champion the plan on its merits!

| Register Your Interest TODAY! |

||

| FREE On-demand Training |

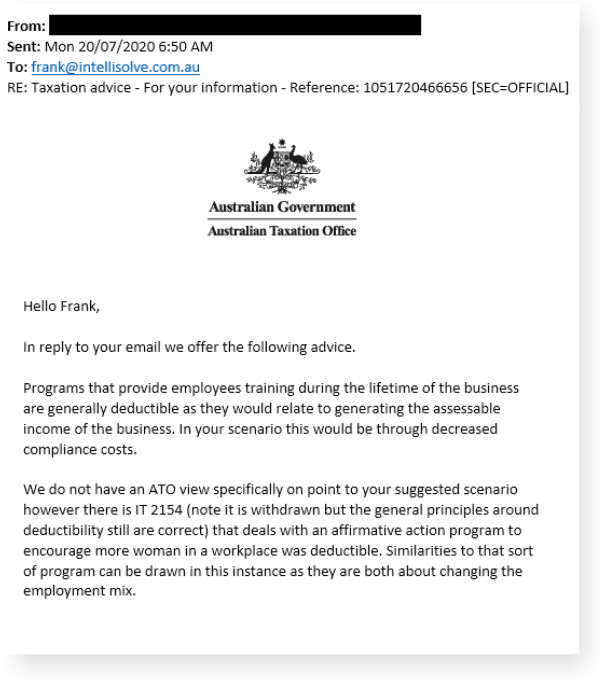

Exhibit A |

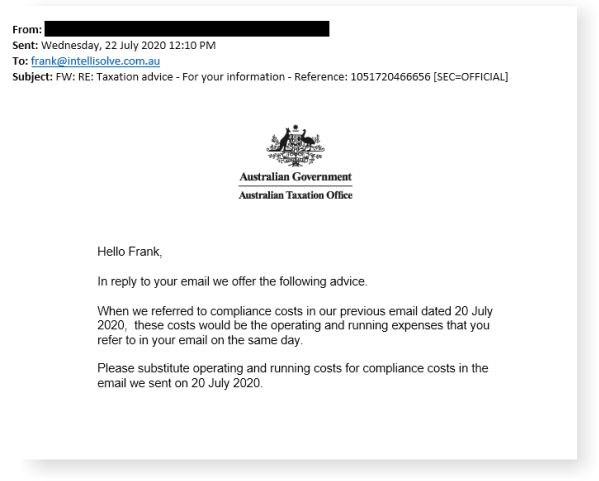

Exhibit B |

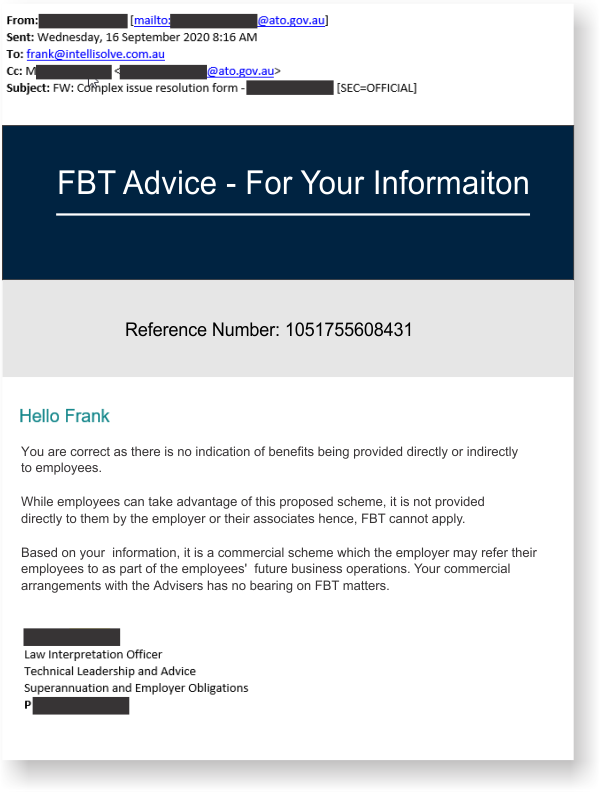

Exhibit C |

|

|

|

|

|

|

|

If so... there are a few important things to know ...

To make it easy - think of our program as the undisputed 'JobBeater' of our time!

Independent of ANY AND ALL Government stimuli and schemes, Deduct Your Home TEAMS takes you by the hand and delivers you a safe, flexible, CASH FLOW-CENTRIC budgeting transformation that can immediately reduce various significant operating costs as it offers unprecedented opportunity to your employees via the one process.

How It Works.

Deduct Your Home TEAMS is a specialised employer and Workforce Care Program that transitions your suitably profiled and willing employees into independent contractors.

Our program significantly lowers operating costs for your organisation by reducing or eliminating any combination of the following unavoidable expenses:

Our unparalleled Workforce Care Program, Deduct Your Home TEAMS, further saves you from the gut-wrenching and expensive path of laying off workers and/or paying out expensive redundancies!

For an employer with say 100 employees enrolled in the program, the cost savings could quickly amount to hundreds-of-thousands (or more likely millions) of dollars per annum ...

... every year for the life of the orgainsation.

now just imaging for an employer with say 1,000 workers how it could easily be ten-fold!

All of the above?

More?

Benefits for Participating Employees:

Specially trained qualified accountants, business advisers and registered tax agents are on-hand to comprehensively service yours’ and your workers requirements.

Enrollment into our Workforce Care Program, Deduct Your Home TEAMS, can be FREE to your employees, ELIMINATING price objections for participating in the program, and it typically COSTS YOU NOTHING within your next annual financial reporting cycle, plus it delivers SIGNIFICANT REGULAR SAVINGS thereafter!

You will be permanently lumbered with high operating costs.

Your employees will be unable to achieve their full potential.

As other organisations roll out Deduct Your Home TEAMS, they will be in a prime position to showcase their attractiveness to prospective executive talent and workers, shareholders and investors -- whereby non-adopters of the program appear second-rate!

You will never be agile enough to compete on the same playing field as your competitors that implement Deduct Your Home TEAMS -- losing appeal to individuals and stakeholders contemplating their next move into - or out of - your organsiation.

Reduced desirability negates the effort made in creating organisational cultures full of diversity and vitality, and may have negative consequences on growth for the forseeable future.

It will be as if other business' have a permanent, legal and ethical 'unfair advantage' over yours.

Without the right information and expertise to guide you, you may be, unknowingly, compromising the:

It’s one thing to make important decisions in a tough environment - you do this every day.

It’s another to flex your emotional intelligence muscles and concede 'you don't know what you don't know'.

By failing to consider NEW and PROVEN pathways that are simply unfamiliar to you – you risk experiencing an undesirable and avoidable fate.

Know the value and power of deploying all the good information and education we provide in the organisation.

Are willing to invest in and implement considered professional help with your goals and objectives.

Have already invested money in training or consulting before, and have successfully implemented that training.

Hire mentors for their expertise and knowledge and heed their advice.

Know the difference between 'cost' and 'investment'.

Do not know the difference between 'cost' and 'investment'.

Are prone to rate-grinding.

Try to sell a “sob story” about why others should work with you cheap (or free).

Do not know your 'why' (what your motivations are, or what your primary goals and objectives are), or have unrealistic expectations.

Are a constant complainer - an expert in concocting 'alibies' for failures.

Are into 'what-if's'.

Are a fence-sitter and happy with mediocrity.

Are un-coachable and fail to respect boundaries.

I know my IP and my clients well, and over the years I've learnt who my expertise does and does not work for.

And I say this with confidence because; if you recognise yourself in what you're reading here, I know you'll do VERY WELL from it.

1. |

Gain first-mover advantage on competing business' in your market where, in the absence of action, you risk potential for due criticism from stakeholders and shareholders. |

2. |

Avoid the direct financial fallout, exacerbated with every passing day you bear higher than necessary operating costs. |

3. |

Secure your place in the que now, rather than risk losing the opportunity for who knows how long being our organisation is purposefully small and whilst this brings limitations, it allows us to work deeply with clients so it’s first-in, first-served! |

4. |

When deciding to proceed with Deduct Your Home TEAMS within 60 days of contacting us, Intellisolve will return 3% of our fee for your business to direct into new or existing community projects which it supports or sponsors. |

The best of planning to you,

Warning and Disclaimer:

Please understand that I truly believe that whilst all information is supplied in good faith, that nowhere else in Australia will you have the opportunity of duplicating the typical results I get for clients with my proprietary strategy, Deduct Your Home.

This is because since 2001, my company alone set out to create, test and continually refine the intellectual property that underpins all of this firstly upon myself, its director, and only then upon our clients.

At various critical stages throughout, I collaborated closely with the ATO as well as dealt with other regulators such as ASIC and the Tax Practitioners Board and, also with the Office of The Federal Treasurer, which at my direct request, discussed my firm's intellectual property (IP), with the sitting Commissioner of Taxation, to have then reverted in writing directly to me, as requested.

Notable others include a then current former Deputy Liberal Prime Minister, other then current Federal front-benchers and, members of the Federal Opposition along with many others.

All up, I have achieved stunning results along with numerous instances of ATO cooperation with my explicit requests to keep my firm’s IP from residing in the public domain.

It is not unreasonable for me to speculate that the average person (and yes – this includes even the most highly regarded tax professionals in Australia), whom might try something like this on their own, will most likely be unsuccessful precisely because:

1. It's very complicated and hard to get right while you're learning the ropes of this specialist field. Make no mistake, that due to the nature of the ever-slow and cumbersome wheels of the many and varied government agencies that oversee our business operation, as well as the AAT which has reviewed various agency decisons on our behalf, there is an extremely lengthy and steep learning curve (which my firm has gone through).

2. To my knowledge, no other professional advisory has ever gone to such extraordinary lengths and;

3. The cash expense and opportunity cost we have incurred is prohibitive to other advisory firms that are squarely focussed on productivity not R & D, hence we stand alone!

From time to time we use 'virtual scenarios' for vision-building and illustrative purposes only (albeit they are meticulously based on our IP and modelled on what is is real for current clients - and achievable depending on one’s specific realities).

Any and all assumptions herein are based on our past and current examination, testing and interpretation of many Federal and State Legislative Acts and Australian Taxation Office Rulings together which may change in the future.

Such also extends to in-depth analysis and field testing of the application of local government planning policies.

Your potential for gaining profit or loss from running a home-based business has not been expressly factored as I have no way to determine your future prospects and possible results in this regard at this point in time.

Even with my close guidance, your results will vary and depend on several key factors - including, but not limited to - your background, experience, intelligence, current financial capacity, ability to be coached and to implement expert advice, your work ethic and more.

The facts are: all business entails risk, planning, testing and measuring - as well as massive and consistent effort and action.

If you're not willing to accept this, please, DO NOT TAKE ANY FURTHER ACTION either alone, with Intellisolve or through anyone else.

Mortgage interest rates and capital returns from property change, which can have a direct impact on your financial position over the short, medium and long-term.

We categorically disclaim, any and all liability and/or loss by you on the basis that at this point in time, we have not given you any personal or business advice of any nature whatsoever - being we have NOT collected and analysed information that pertains to your business, financial and personal circumstances which means we cannot comment or advise as to the suitability or otherwise of the information herein as it relates to your situation.

If you want protection under the law, either contact the government agency you beleive appropriate and deal directly with them - or find another firm that has done anything remotely similar or far better yet, "exactly this".

Alternatively, contact us for a consultation from where it may arise that you become a client, thus affording yourself certain and solid protection under the law.

Taxation and other laws are subject to change as is the interpretation of these laws by the various Commonwealth, State and local regulators. Therefore like all committed professionals, we work hard to keep appropriately abreast however and in particular being that we focus heavily on the home business sector, we hold the view that our expert well-formed, documented and regulator vetted opinions are peerless.

Consequently, we duly caution you against acting upon others' advice taken in this specialist and niche area without, and at the very least, engaging us for a second opinion.

Finally, any and all references to me, my, myself and or I, do for the stated purpose, equally pertain to Genovesi Enterprises Pty Ltd.